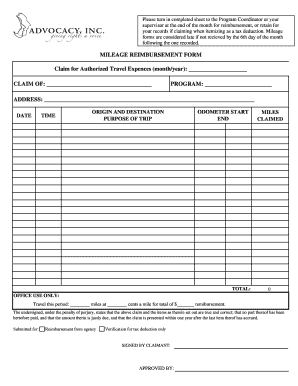

The details you are disclosing now about being "required" to attend meetings and other company-sponsored events doesn't sound good. in order to save on withholding taxes, social security, unemployment, workman comp, and all the other expenses involved with bona fide employees. If you don't receive 1099's from other companies, only this one, there is the chance that the org is claiming you as an I.C. I'm not sure what exactly you mean by "same work." I don't carry out the same types of tasks for other non-profits, but I do volunteer for others, and occassionaly the volunteering for these other groups requires some driving. I set the majority of my own hours- I work remotely when I want to, with the exception of meetings, calls, and in-person events (approx once per month) whose scheduling are beyond my control. In response to each of your questions: I am paid on a 1099 and not a W-2. Just being paid at the end of the year on a 1099 instead of a W-2 does NOT legally establish status as a I.C.Īh. Also, do you set your own hours and schedule to perform the work, and not have to follow their instructions? That is also very critical to the litmus test. contractors versus bona fides, tho.īy offering to reimburse you partially for your mileage the org is dancing dangerously close to blurring that line.ĭo you also perform the same work for other companies or non-profits besides this one? That is important to establish you as a true I.C. Make certain you can -pass the IRS litmus test for indep. (self-employed) worker, you should be deducting your auto expenses on your Schedule C, either by taking the standard business rate or by using the actual method. contractor, I am surprised that they offered you any mileage reimbursement at all.Īs you already stated, as an I.C. ** If so, do I require written evidence of my mileage, as line 8b of Schedule C asks?ĭrawpoker wrote:Frankly, if you are billing this org for your services as an indep. * Third, if I'm concerned about coming off as demanding or argumentative with my colleagues and superiors, might it be worthwhile to forgo any reimbursements and instead claim deductions on Schedule C (Form 1040) of my 2016 return? (I assume you can't get reimbursed and claim a tax deduction.) Would I end up seeing as much money back through a deduction as I would through a reimbursement? * Second, what is the legal relationship between the IRS's mileage rates and the ways in which organizations (like the non-profit I'm contracting for) should behave? Put differently, do the IRS's mileage rates merely serve as guideposts, rather than laws, for organizations that reimburse contractors (or employees) who use their personal cars for business purposes? * First, am I right to assume that I could correctly claim the business rate for the purpose of reimbursements?.

#Independent contractor mileage reimbursement how to#

I'm wondering how to proceed, and have a few questions. In the past few weeks I've driven ~350 miles for work, and I'm regretting my decision not to argue for the larger of the two rates. However, the organization is relatively small, I have social connections to some of my colleagues, and I work remotely, so I was disinclined to put up a fight, and have since accepted reimbursements at the rate of 14 cents/mile. I assumed that the lower rate should apply to freely-given donations to charitable organizations, not work performed for a non-profit as an independent contractor. I was told that I would be reimbursed at the standard rate for charitable organizations instead, which is 14 cents/mile. When I got involved with the organization in the fall I requested that I be reimbursed for mileage according to the IRS's standard business mileage rate (50+ cents/mile). I'm currently an independent contractor for a non-profit, and I'm required to use my car for the job.

0 kommentar(er)

0 kommentar(er)